Step 4 of the Global Walkout

Small is beautiful - especially when it comes to banking

Hopefully you’re already signed up to the Global Walkout; if not, do it right now!

Step 4 is the most challenging one yet, but also one of the most important:

Step 4: Move as many accounts as you can to a credit union or local bank.

Find a banking institution that is as independent, and as local to you, as possible.

Try to open your new accounts, and close your old ones with big banks, in person so you can explain the global walkout and WHY you are putting in the effort to change your accounts.

There are handouts on the Step 4 info page that you can give to bank staff, to explain why you’re moving your accounts to a smaller, community-centred financial services provider.

But finding a smaller bank and moving all my accounts is a hassle - why should I bother?

Smaller banks support local family-run businesses more. If you invest your money in them, you are helping your local economy overall.

If enough people take their money away from the big banks, they will have less control.

In some cases, smaller banks are less controlled by big corporations and the government.

We are unsure what the future holds. We know that the globalists are trying to bring in a digital ID and a cashless society. This step alone will not prevent this, but it’s a start.

Check out the tips and resources on the Step 4 page of the Global Walkout.

UPDATE:

A reader has notified me - thanks, Kerri! - that the Australian Citizens Party is pushing for the establishment of a national post office bank, operating out of Australia Post offices, that can serve communities and force the Big Four banks to compete.

You can learn more about the Citizens Party’s banking policies, and how you can get behind them, here.

I’ve excerpted the following text and photos from the Citizens Party email that Kerri forwarded to me:

Historic discussion in Parliament House in support of the public post office bank

The forum on 7 September in Parliament House was hosted by the Licensed Post Office Group (LPOG), which represents the interests of the almost 3,000 small business community post offices across Australia.

The attendance was remarkable in its diversity. Participants included:

four politicians from four different political parties

staffers representing many more MPs and Senators

a former Productivity Commission economist

an award-winning journalist who has documented regional bank branch closures

members of the public who are strong supporters of the policy.

The common message from all the speakers was that a public postal bank is a win-win solution for Australia’s economy and people.

LPOG Chairman Andrew Hirst and Executive Director Angela Cramp chaired the forum in Parliament, explaining that a postal bank is a policy they have supported for many years.

What the banks don't want to know about

“We service the community that the banks don’t want to know about,” Andrew Hirst said. “We service the community that big business doesn’t want to know about. They’re our bread and butter; they’re our people.”

When banks close branches, claiming customers are banking online, the small business owners who need to deposit and withdraw cash, the elderly, the disabled, and anyone who wants the certainty of face-to-face services, queue at post offices to do their banking.

Bank@Post is fragile

The current service that post offices provide, Bank@Post, is tenuous, as the private banks it represents are reluctant to reimburse the post offices for the service. Indeed, ANZ refused, and the other three major banks took advantage of the turmoil following Christine Holgate’s removal to reduce their payments drastically.

They also charge their customers heavy fees of up to $4 and $5 for using the service, of which only about $1.40 goes to the post office that actually serves the customer.

A dedicated, government-owned postal bank is the win-win solution, Mr Hirst repeatedly said, as using the existing post office network will ensure banking services are affordable, and the revenue from banking will support the viability of post offices.

Big Four banks seek to maximise profit by closing bank branches

Mr Hirst acknowledged the presence of award-winning journalist Dale Webster, whose reporting on the true extent of regional bank branch closures through her news service The Regional won her multiple journalism awards.

The issue of bank branch closures, especially in regional Australia, is driving much of the support for a post office bank that can guarantee banking services for all communities but also force the major banks to compete.

City Councils pass resolutions in support of the public post office bank

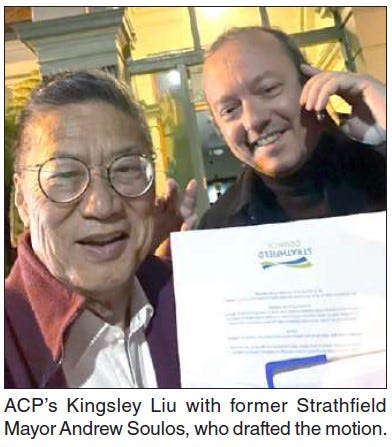

The night before the forum, Strathfield City Council in Sydney became the fifth council across Australia to pass a resolution endorsing the postal bank policy, out of concern for the impact of bank closures and lack of competition on their communities.

Share your top tips for finding smaller banks in the Comments section:

This is such a great idea. I’ve banked with my credit union for nearly 40 years. They are conservative in their financial dealings (they keepmtheir loans in house and don’t sell them off in those dubious tranches), have better rates, better service, and fewer fees than ANY big bank. I don’t want to solicit uninvited on this site, but I’m a huge proponent of my credit union. If you’re looking for a great financial institution and you’re unsure of where to start, let me know and I’ll give you their name/link. I really have so many good things to say about my FCU.